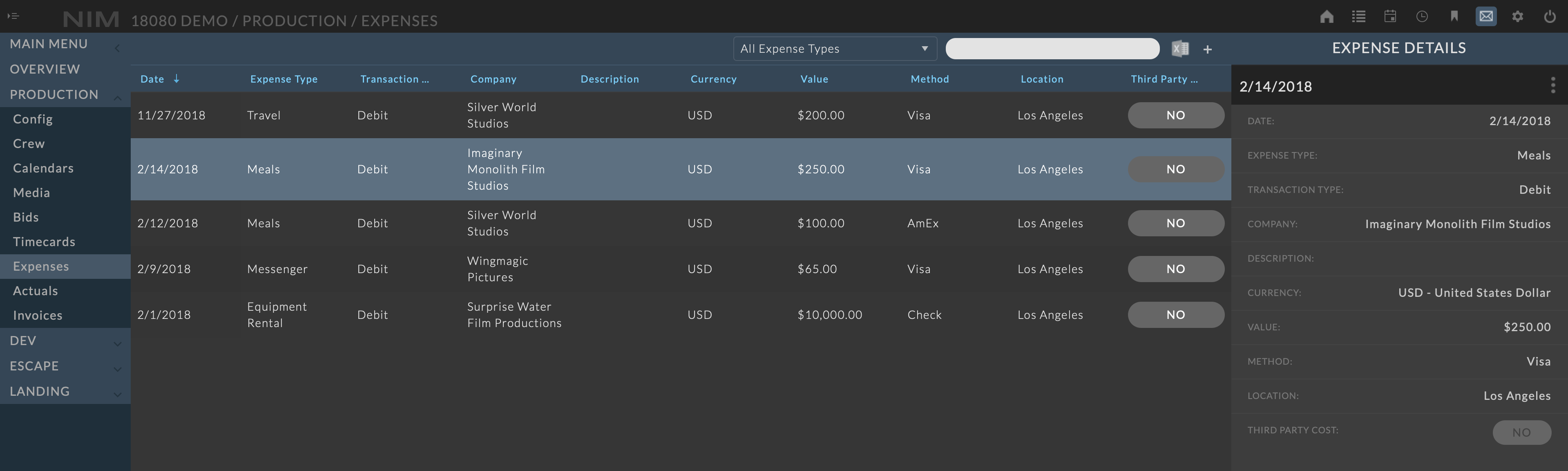

Expense Overview¶

Expenses are used to track objects or services that were paid for directly and attributable to a job. Expenses additionally include the option to add a credit for any item that may have been refunded. In job actualization, expenses entered here are actualized against expense line items from awarded bids. Expenses are organized by expense types defined in the administrative section of NIM.

For more information on defining expense types, please refer to the Expense Types section of the documentation. Job expenses are accessible from the Production > Expenses menu.

Note

To track expenses that are not attributable directly to a job, but are for the company, consider creating a “Studio” or “Overhead” job which holds all items that the company owns.

Filters¶

Expense Types¶

The expense grid is filterable by type using the expense type dropdown in the toolbar. By default all expense types are shown.

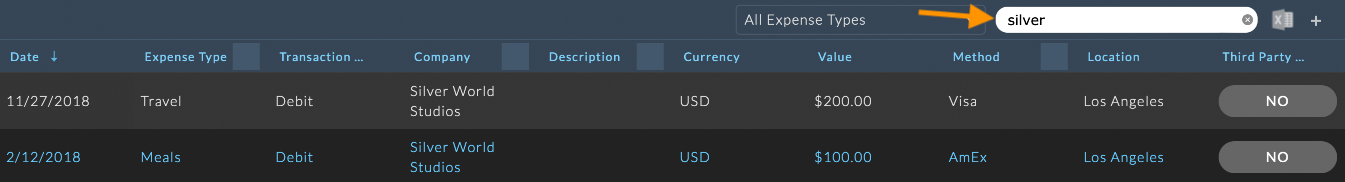

Search¶

Entering a term in the search field will display all expense items that have an expense type, company name, description, or payment method that matches the search criteria.

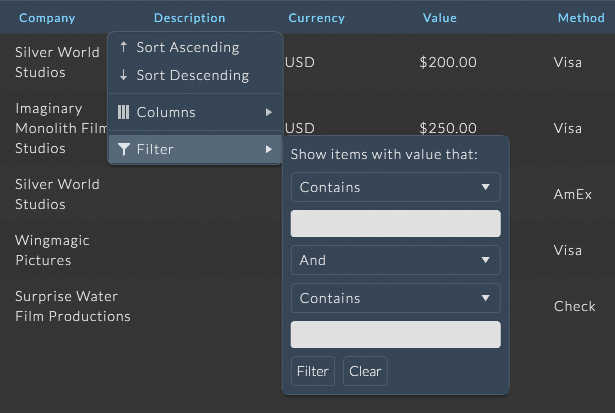

Column Filters¶

Filtering by grid column menus provides access to more complex filtering options per column. Column filters can be used in conjunction with the other filters to create more refined filter rules.

To filter the expense grid by a column menu, hover of the column to filter and click the ellipsis menu to the right of the column header and select your filter options from the Filter menu

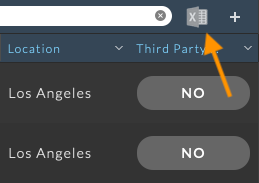

Export to Excel¶

The expense grid can be exported to Excel using the Export to Excel button at the top right of the expense grid toolbar.

Any filters that have been applied to the grid will be respected in the export.

Adding Expenses¶

To add a new expense, click the  button at the top right of the expense toolbar. The expense info panel will appear and you can enter the details. When done click the Save button at the bottom of the info panel to save your changes. Click the Cancel button to return to the grid without creating a new expense.

button at the top right of the expense toolbar. The expense info panel will appear and you can enter the details. When done click the Save button at the bottom of the info panel to save your changes. Click the Cancel button to return to the grid without creating a new expense.

Available options include:

Date |

The date to associate with the expense. |

Expense Type |

This is the expense type that should be associated with the expense. |

Transaction Type |

Options are Debit or Credit. A debit transaction is money paid and a credit transaction is incoming money. An example of a credit transaction may be the return of an item. |

Company |

The entity the expense was paid to or where the credit was received from. |

Description |

A brief description of the expense. |

Currency |

The currency of the expense value. (Defaults to the Job Currency.) |

Value |

The value of the expense. |

Method |

The payment method used. |

Location |

The location of the expense. |

Third Party Cost |

Flags this expense as a third party cost. Expenses can be bid for as third party costs when creating a bid in NIM, and third party costs will be grouped separately in Actuals. |

Editing Expenses¶

To edit an expense item, click on a row from the grid to load the expense item info panel.

Click on the ellipsis menu in the expense item info panel and choose “Edit”.

Make the necessary changes and click the “Save” button at the bottom of the info panel to save your changes.

Click the cancel button to return to the view mode without saving changes.

Deleting Expenses¶

Delete an expense item entry by selecting the expense item from the grid, clicking the ellipsis menu in the expense item panel, and selecting “Delete”. You will be prompted to confirm deletion of the expense item.